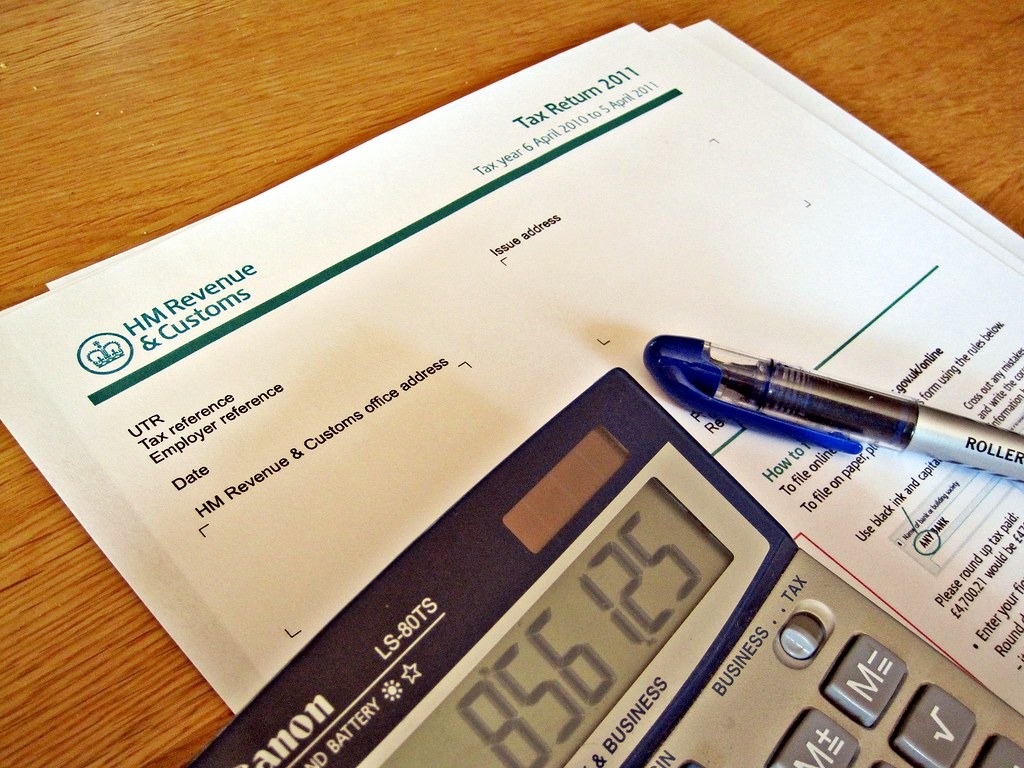

Thousands of Britons utilising platforms like Airbnb for renting out rooms are facing a potential minefield of fines due to an upcoming change in HMRC regulations. HMRC now requires short-term let platforms, including Airbnb, to report their users’ earnings directly to them, effective from January 1.

For those supplementing their income by offering a spare room, it’s crucial to comprehend the implications. Mike Parkes, the technical director at GoSimpleTax, highlighted the necessity for even casual landlords to recognise their tax obligations: “Renting out a room can be a lucrative venture, but it’s imperative to acknowledge the tax liabilities associated with it.”

While many might assume an automatic exemption due to earning below the government’s £7,500 threshold, Parkes cautioned that surpassing this limit could inadvertently put individuals in a taxable bracket. Charging more than £625 per month could unknowingly trigger tax responsibilities, catching numerous landlords off guard.

Stats and Figures

The Rent A Room tax relief offers a safety net, granting exemption to Airbnb users and specific landlords earning under £7,500 annually from furnished room rentals. If the income is jointly shared, this threshold will be reduced by half to £3,750.

However, this leaves a significant number of side-hustle landlords susceptible to unexpected tax liabilities, especially if their earnings breach the £7,500 benchmark.

Experts are sounding alarms, urging Britons engaged in room rentals to take preemptive measures before the impending deadline. The looming prospect of fines for non-compliance has put a spotlight on the urgency of understanding tax liabilities in this domain.

The impending self-assessment tax return deadline on January 31 compounds the pressure. Parkes advised landlords to brace themselves and explore options such as discussing payment plans with HMRC. “Though paying tax can seem daunting, exploring options like a manageable monthly payment plan with HMRC can alleviate the burden,” Parkes added.

The imminent changes underscore the need for vigilance among room-renting individuals, emphasising the importance of understanding and fulfilling tax obligations before the deadline.